0

35

Financial review

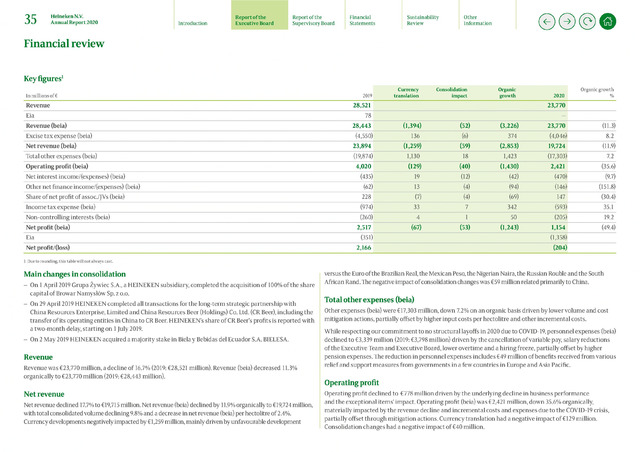

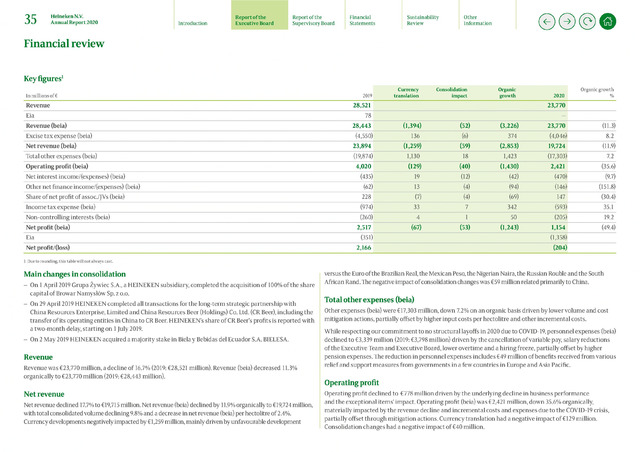

Key figures1

-

Net revenue (beia)

Main changes in consolidation

Revenue

Net revenue

Total other expenses (beia)

Operating profit

Heineken N.V.

Annual Report 2020

Introduction

Report of the

Executive Board

Report of the

Supervisory Board

Financial

Statements

Sustainability

Review

Other

Information

In millions of

2019

Currency

translation

Consolidation

impact

Organic

growth

2020

Organic growth

Revenue

28,521

23,770

Eia

78

Revenue (beia)

28,443

(1,394)

(52)

(3,226)

23,770

(11.3)

Excise tax expense (beia)

(4,550)

136

(6)

374

(4,046)

8.2

23,894

(1,259)

(59)

(2,853)

19,724

(11.9)

Total other expenses (beia)

(19,874)

1,130

18

1,423

(17,303)

7.2

Operating profit (beia)

4,020

(129)

(40)

(1,430)

2,421

(35.6)

Net interest income/(expenses) (beia)

(435)

19

(12)

(42)

(470)

(9.7)

Other net finance income/(expenses) (beia)

(62)

13

(4)

(94)

(146)

(151.8)

Share of net profit of assoc./JVs (beia)

228

(7)

(4)

(69)

147

(30.4)

Income tax expense (beia)

(974)

33

7

342

(593)

35.1

Non-controlling interests (beia)

(260)

4

1

50

(205)

19.2

Net profit (beia)

2,517

(67)

(53)

(1,243)

1,154

(49.4)

Eia

(351)

(1,358)

Net profit/(loss)

2,166

(204)

1 Due to rounding, this table will not always cast.

- On 1 April 2019 Grupa Zywiec S.A., a HEINEKEN subsidiary, completed the acquisition of 100% of the share

capital of Browar Namystów Sp. z o.o.

- On 29 April 2019 HEINEKEN completed all transactions for the long-term strategic partnership with

China Resources Enterprise, Limited and China Resources Beer (Holdings) Co. Ltd. (CR Beer), including the

transfer of its operating entities in China to CR Beer. HElNEKEN's share of CR Beer's profits is reported with

a two-month delay, starting on 1 July 2019.

- On 2 May 2019 HEINEKEN acquired a majority stake in Biela y Bebidas del Ecuador S.A. BIELESA.

Revenue was €23,770 million, a decline of 16.7% (2019: €28,521 million). Revenue (beia) decreased 11.3%

organically to €23,770 million (2019: €28,443 million).

Net revenue declined 17.7% to €19,715 million. Net revenue (beia) declined by 11.9% organically to €19,724 million,

with total consolidated volume declining 9.8% and a decrease in net revenue (beia) per hectolitre of 2.4%.

Currency developments negatively impacted by €1,259 million, mainly driven by unfavourable development

versus the Euro of the Brazilian Real, the Mexican Peso, the Nigerian Naira, the Russian Rouble and the South

African Rand. The negative impact of consolidation changes was €59 million related primarily to China.

Other expenses (beia) were €17,303 million, down 7.2% on an organic basis driven by lower volume and cost

mitigation actions, partially offset by higher input costs per hectolitre and other incremental costs.

While respecting our commitment to no structural layoffs in 2020 due to COVlD-19, personnel expenses (beia)

declined to €3,339 million (2019: €3,798 million) driven by the cancellation of variable pay, salary reductions

of the Executive Team and Executive Board, lower overtime and a hiring freeze, partially offset by higher

pension expenses. The reduction in personnel expenses includes €49 million of benefits received from various

relief and support measures from governments in a few countries in Europe and Asia Pacific.

Operating profit declined to €778 million driven by the underlying decline in business performance

and the exceptional items' impact. Operating profit (beia) was €2,421 million, down 35.6% organically,

materially impacted by the revenue decline and incremental costs and expenses due to the COVlD-19 crisis,

partially offset through mitigation actions. Currency translation had a negative impact of €129 million.

Consolidation changes had a negative impact of €40 million.