0

176

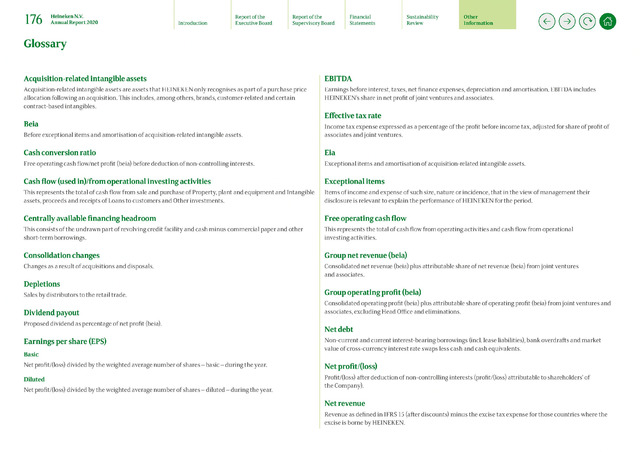

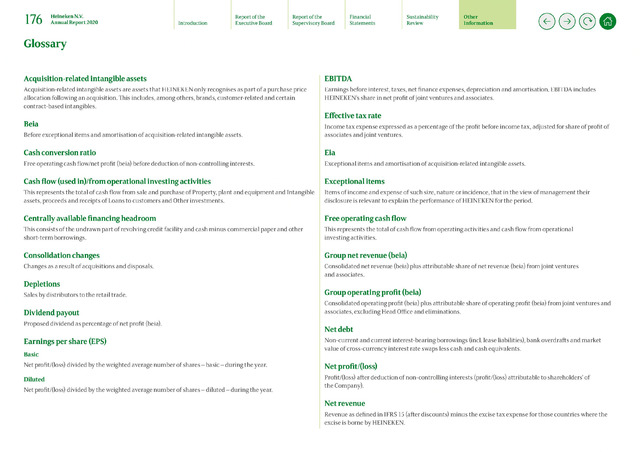

Glossary

Acquisition-related intangible assets

Beia

Cash conversion ratio

Cash flow (used in)/from operational investing activities

Centrally available financing headroom

Consolidation changes

Depletions

Dividend payout

Earnings per share (EPS)

EBITDA

Effective tax rate

Eia

Exceptional items

Free operating cash flow

Group net revenue (beia)

Group operating profit (beia)

Net debt

Net profit/(loss)

Net revenue

Heineken N.V.

Annual Report 2020

Introduction

Report of the

Executive Board

Report of the

Supervisory Board

Financial

Statements

Sustainability

Review

Other

Information

Acquisition-related intangible assets are assets that HEINEKEN only recognises as part of a purchase price

allocation following an acquisition. This includes, among others, brands, customer-related and certain

contract-based intangibles.

Before exceptional items and amortisation of acquisition-related intangible assets.

Free operating cash flow/net profit (beia) before deduction of non-controlling interests.

This represents the total of cash flow from sale and purchase of Property, plant and equipment and Intangible

assets, proceeds and receipts of Loans to customers and Other investments.

This consists of the undrawn part of revolving credit facility and cash minus commercial paper and other

short-term borrowings.

Changes as a result of acquisitions and disposals.

Sales by distributors to the retail trade.

Proposed dividend as percentage of net profit (beia).

Basic

Net profit/(loss) divided by the weighted average number of shares - basic - during the year.

Diluted

Net profit/(loss) divided by the weighted average number of shares - diluted - during the year.

Earnings before interest, taxes, net finance expenses, depreciation and amortisation. EBITDA includes

HEINEKEN's share in net profit of joint ventures and associates.

Income tax expense expressed as a percentage of the profit before income tax, adjusted for share of profit of

associates and joint ventures.

Exceptional items and amortisation of acquisition-related intangible assets.

Items of income and expense of such size, nature or incidence, that in the view of management their

disclosure is relevant to explain the performance of HEINEKEN for the period.

This represents the total of cash flow from operating activities and cash flow from operational

investing activities.

Consolidated net revenue (beia) plus attributable share of net revenue (beia) from joint ventures

and associates.

Consolidated operating profit (beia) plus attributable share of operating profit (beia) from joint ventures and

associates, excluding Head Office and eliminations.

Non-current and current interest-bearing borrowings (incl. lease liabilities), bank overdrafts and market

value of cross-currency interest rate swaps less cash and cash equivalents.

Profit/(loss) after deduction of non-controlling interests (profit/(loss) attributable to shareholders' of

the Company).

Revenue as defined in IFRS 15 (after discounts) minus the excise tax expense for those countries where the

excise is borne by HEINEKEN.