O A

Notes to the Consolidated Financial Statements (continued)

-

-

12.2 Deferred tax assets and liabilities

-

-

-

-

-

Introduction Report of the Executive Board Report of the Supervisory Board

2018

2017

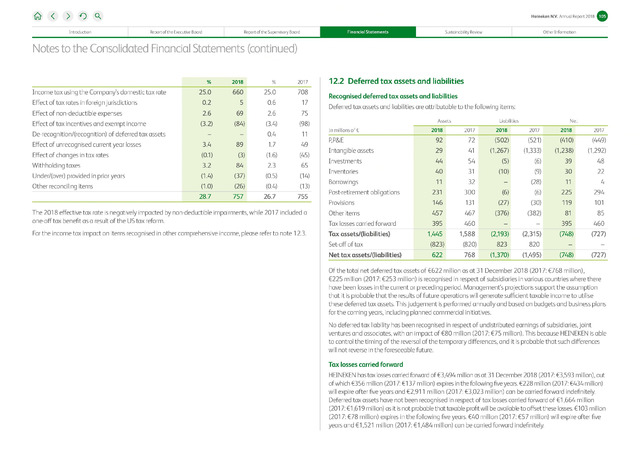

Income tax using the Company's domestic tax rate

25.0

660

25.0

708

Effect of tax rates in foreign jurisdictions

0.2

5

0.6

17

Effect of non-deductible expenses

2.6

69

2.6

75

Effect of tax incentives and exempt income

(3.2)

(84)

(3.4)

(98)

De-recognition/(recognition) of deferred tax assets

0.4

11

Effect of unrecognised current year losses

3.4

89

1.7

49

Effect of changes in tax rates

(0.1)

(3)

(1.6)

(45)

Withholding taxes

3.2

84

2.3

65

Under/(over) provided in prior years

(1.4)

(37)

(0.5)

(14)

Other reconciling items

(1.0)

(26)

(0.4)

(13)

28.7

757

26.7

755

The 2018 effective tax rate is negatively impacted by non-deductible impairments, while 2017 included a

one-off tax benefit as a result of the US tax reform.

For the income tax impact on items recognised in other comprehensive income, please refer to note 12.3.

Financial Statements

Sustainability Review

Heineken N.V. Annual Report 2018^10

Other Information

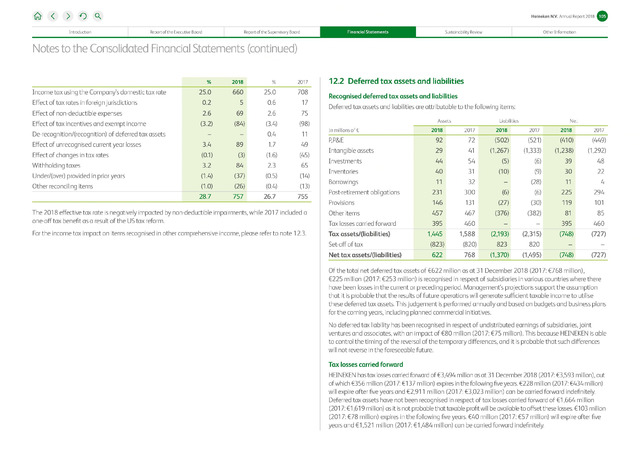

Recognised deferred tax assets and liabilities

Deferred tax assets and liabilities are attributable to the following items:

Assets Liabilities Net

In millions of

2018

2017

2018

2017

2018

2017

P,P&E

92

72

(502)

(521)

(410)

(449)

Intangible assets

29

41

(1,267)

(1,333)

(1,238)

(1,292)

Investments

44

54

(5)

(6)

39

48

Inventories

40

31

(10)

(9)

30

22

Borrowings

11

32

(28)

11

4

Post-retirement obligations

231

300

(6)

(6)

225

294

Provisions

146

131

(27)

(30)

119

101

Other items

457

467

(376)

(382)

81

85

Tax losses carried forward

395

460

395

460

Tax assets/(liabilities)

1,445

1,588

(2,193)

(2,315)

(748)

(727)

Set-off of tax

(823)

(820)

823

820

Net tax assets/(liabilities)

622

768

(1,370)

(1,495)

(748)

(727)

Of the total net deferred tax assets of €622 million as at 31 December 2018 (2017: €768 million),

€225 million (2017: €253 million) is recognised in respect of subsidiaries in various countries where there

have been losses in the current or preceding period. Management's projections support the assumption

that it is probable that the results of future operations will generate sufficient taxable income to utilise

these deferred tax assets. This judgement is performed annually and based on budgets and business plans

for the coming years, including planned commercial initiatives.

No deferred tax liability has been recognised in respect of undistributed earnings of subsidiaries, joint

ventures and associates, with an impact of €80 million (2017: €75 million). This because HEINEKEN is able

to control the timing of the reversal of the temporary differences, and it is probable that such differences

will not reverse in the foreseeable future.

Tax losses carried forward

HEINEKEN has tax losses carried forward of €3,494 million as at 31 December 2018 (2017: €3,593 million), out

of which €356 million (2017: €137 million) expires in the following five years. €228 million (2017: €434 million)

will expire after five years and €2,911 million (2017: €3,023 million) can be carried forward indefinitely

Deferred tax assets have not been recognised in respect of tax losses carried forward of €1,664 million

(2017: €1,619 million) as it is not probable that taxable profit will be available to offset these losses. €103 million

(2017: €78 million) expires in the following five years. €40 million (2017: €57 million) will expire after five

years and €1,521 million (2017: €1,484 million) can be carried forward indefinitely.