121

Notes to the Consolidated Financial Statements (continued)

FEMSA

34. HEINEKEN entities

Control of HEINEKEN

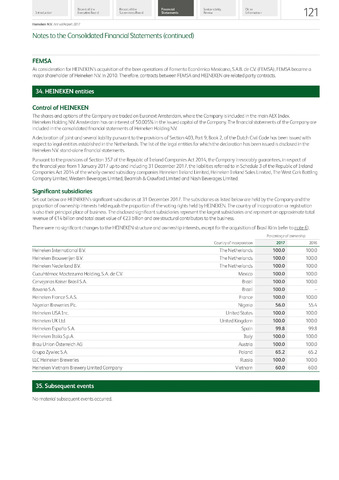

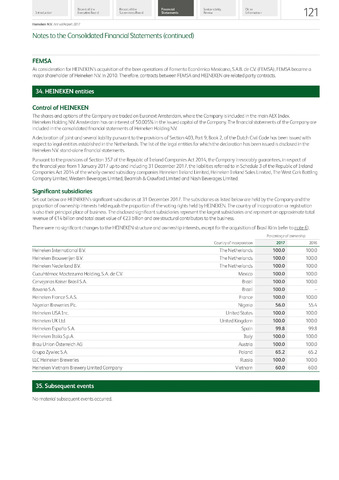

Significant subsidiaries

-

35. Subsequent events

Report of the

Report of the

Financial

Sustainability

Other

Introduction

Executive Board

Supervisory Board

Statements

Review

Information

Heineken N.V. Annual Report 2017

As consideration for HEINEKEN's acquisition of the beer operations of Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA), FEMSA became a

major shareholder of Heineken N.V. in 2010. Therefore, contracts between FEMSA and HEINEKEN are related party contracts.

The shares and options of the Company are traded on Euronext Amsterdam, where the Company is included in the main AEX Index.

Heineken Holding N.V. Amsterdam has an interest of 50.005% in the issued capital of the Company. The financial statements of the Company are

included in the consolidated financial statements of Heineken Holding NV

A declaration of joint and several liability pursuant to the provisions of Section 403, Part 9, Book 2, of the Dutch Civil Code has been issued with

respect to legal entities established in the Netherlands. The list of the legal entities for which the declaration has been issued is disclosed in the

Heineken N.V. stand-alone financial statements.

Pursuant to the provisions of Section 357 of the Republic of Ireland Companies Act 2014, the Company irrevocably guarantees, in respect of

the financial year from 1 January 2017 up to and including 31 December 201 7, the liabilities referred to in Schedule 3 of the Republic of Ireland

Companies Act 2014 of the wholly-owned subsidiary companies Heineken Ireland Limited, Heineken Ireland Sales Limited, The West Cork Bottling

Company Limited, Western Beverages Limited, Beamish Crawford Limited and Nash Beverages Limited.

Set out below are HEINEKEN's significant subsidiaries at 31 December 2017. The subsidiaries as listed below are held by the Company and the

proportion of ownership interests held equals the proportion of the voting rights held by HEINEKEN. The country of incorporation or registration

is also their principal place of business. The disclosed significant subsidiaries represent the largest subsidiaries and represent an approximate total

revenue of €14 billion and total asset value of €23 billion and are structural contributors to the business.

There were no significant changes to the HEINEKEN structure and ownership interests, except for the acquisition of Brasil Kirin (referto note 6).

Percentage of ownership

Country of incorporation

2017

2016

Heineken International B.V.

The Netherlands

100.0

100.0

Heineken Brouwerijen B.V.

The Netherlands

100.0

100.0

Heineken Nederland B.V.

The Netherlands

100.0

100.0

Cuauhtémoc Moctezuma Holding, S.A. de C.V.

Mexico

100.0

100.0

Cervejarias Kaiser Brasil S.A.

Brazil

100.0

100.0

Bavaria S.A.

Brazil

100.0

Heineken France S.A.S.

France

100.0

100.0

Nigerian Breweries Plc.

Nigeria

56.0

55.4

Heineken USA Inc.

United States

100.0

100.0

Heineken UK Ltd

United Kingdom

100.0

100.0

Heineken EspanaS.A.

Spain

99.8

99.8

Heineken Italia S.p.A.

Italy

100.0

100.0

Brau Union Österreich AG

Austria

100.0

100.0

GrupaZywiecS.A.

Poland

65.2

65.2

LLC Heineken Breweries

Russia

100.0

100.0

Heineken Vietnam Brewery Limited Company

Vietnam

60.0

60.0

No material subsequent events occurred.