Notes to the Consolidated Financial Statements continued

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Reportofthe Reportofthe Financial Other

Contents Overview Executive Board Supervisory Board Statements Information

Property, plant and equipment under construction

P, P E under construction mainly relates to expansion of the brewing capacity in various countries.

Capitalised borrowing costs

During 2015, borrowing costs amounting to EUR3 million have been capitalised (201 A: EUR5 million).

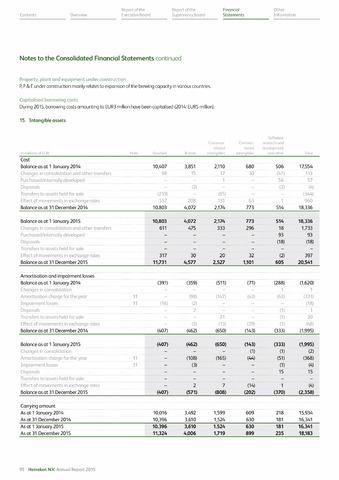

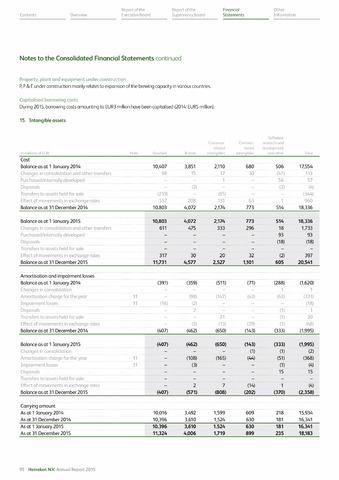

15. Intangible assets

In millions of EUR

Note

Goodwill

Brands

Customer-

related

intangibles

Contract-

based

intangibles

Software,

research and

development

and other

Total

Cost

Balance as at 1 January 2014

10,407

3,851

2,110

680

506

17,554

Changes in consolidation and other transfers

98

15

17

30

(47)

113

Purchased/internally developed

1

56

57

Disposals

(2)

(2)

(4)

Transfers to assets held for sale

(259)

(85)

(344)

Effect of movements in exchange rates

557

208

131

63

1

960

Balance as at 31 December 2014

10,803

4,072

2,174

773

514

18,336

Balance as at 1 January 2015

10,803

4,072

2,174

773

514

18,336

Changes in consolidation and other transfers

611

475

333

296

18

1,733

Purchased/internally developed

93

93

Disposals

(18)

(18)

Transfers to assets held for sale

Effect of movements in exchange rates

317

30

20

32

(2)

397

Balance as at 31 December 2015

11,731

4,577

2,527

1,101

605

20,541

Amortisation and impairment losses

Balance as at 1 January 2014

(391)

(359)

(511)

(71)

(288)

(1,620)

Changes in consolidation

1

1

Amortisation charge for the year

11

(98)

(147)

(43)

(43)

(331)

Impairment losses

11

(16)

(2)

(18)

Disposals

2

(1)

1

Transfers to assets held for sale

21

(1)

20

Effect of movements in exchange rates

(5)

(13)

(29)

(1)

(48)

Balance as at 31 December 2014

(407)

(462)

(650)

(143)

(333)

(1,995)

Balance as at 1 January 2015

(407)

(462)

(650)

(143)

(333)

(1,995)

Changes in consolidation

(1)

(1)

(2)

Amortisation charge for the year

11

(108)

(165)

(44)

(51)

(368)

Impairment losses

11

(3)

(1)

(4)

Disposals

15

15

Transfers to assets held for sale

Effect of movements in exchange rates

2

7

(14)

1

(4)

Balance as at 31 December 2015

(407)

(571)

(808)

(202)

(370)

(2,358)

Carrying amount

Asatl January 2014

10,016

3,492

1,599

609

218

15,934

As at 31 December 2014

10,396

3,610

1,524

630

181

16,341

Asatl January2015

10,396

3,610

1,524

630

181

16,341

As at 31 December 2015

11,324

4,006

1,719

899

235

18,183

95 Heineken N.V. Annual Report 2015