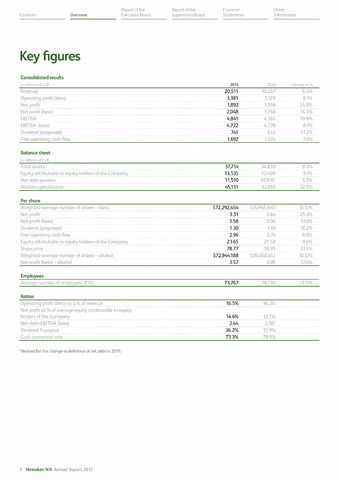

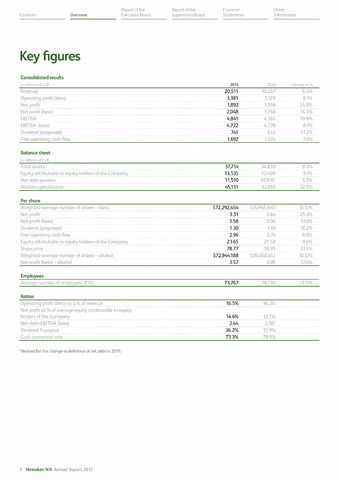

Key figures

Reportofthe Reportofthe Financial Other

Contents Overview Executive Board Supervisory Board Statements Information

Consolidated results

In millions of EUR

2015

Change in

Revenue

20,511

19,257

6.5%

Operating profit (beia)

3,381

3,129

8.1%

Net profit

1,892

1,516

24.8%

Net profit (beia)

2,048

1,758

16.5%

EBITDA

4,841

4,365

10.9%

EBITDA (beia)

4,722

4,370

8.1%

Dividend (proposed)

741

632

17.2%

Free operating cash flow

1,692

1,574

7.5%

Balance sheet

In millions of EUR

Total assets

37,714

34,830

8.3%

Equity attributable to equity holders of the Company

13,535

12,409

9.1%

Net debt position

11,510

10.9101

5.5%

Market capitalisation

45,131

33,955

32.9%

Per share

Weighted average number of shares - basic

572,292,454

574,945,645

(0.5)%

Net profit

3.31

2.64

25.4%

Net profit (beia)

3.58

3.06

17.0%

Dividend (proposed)

1.30

1.10

18.2%

Free operating cash flow

2.96

2.74

8.0%

Equity attributable to equity holders of the Company

23.65

21.58

9.6%

Share price

78.77

58.95

33.6%

Weighted average number of shares - diluted

572,944,188

576,002,613

(0.5)%

Net profit (beia) - diluted

3.57

3.05

17.0%

Employees

Average number of employees (FTE)

73,767

76,136

(3.1)%

Ratios

Operating profit (beia) as a of revenue

16.5%

16.2%

Net profit as of average equity attributable to equity

holders of the Company

14.6%

12.7%

Net debt/EBITDA (beia)

2.44

2.501

Dividend payout

36.2%

35.9%

Cash conversion rate

73.3%

78.9%

1 Revised for the change in definition of net debt in 2015.

3 Heineken N.V. Annual Report 2015