Risk Management

HEINEKEN

Reportofthe Reportofthe Financial Other

Contents Overview Executive Board Supervisory Board Statements Information

This section presents an overview of HEINEKEN's approach to risk management: HEINEKEN's internal control and risk management systems, risk profile,

risk appetite and a description of the nature and extent of its exposure to risks.

Effective management of risk forms an integral part of how HEINEKEN operates as a business and is embedded in day-to-day operations. Responsibility

for identifying potential strategic, operational, reporting and compliance risks, and for implementing fit-for-purpose responses, lies primarily with line

management. Group-wide risk management priorities are defined by regional and functional management and endorsed by the Executive Board, who

bears ultimate responsibility for managing the main risks faced by the Company and for reviewing the adeguacy of HEINEKEN's internal control system.

Risk profile

HEINEKEN is predominantly a single-product business, operating throughout the world in the alcohol industry. HEINEKEN is present in more than

70 countries, with a growing share of its revenues originated in emerging markets.

In recent years, there has been increased media, social and political criticism directed at the alcoholic beverage industry. An increasingly negative

perception in society towards alcohol could prompt legislators to implement further restrictive measures such as limitations on availability, advertising,

sponsorships, distribution and points of sale and increased tax. This may cause changes in consumption trends, which could lead to a decrease in the brand

eguity and sales of HEINEKEN's products. In addition, it could adversely affect HEINEKEN's commercial freedom to operate and restrict the availability of

HEINEKEN's products.

HEINEKEN has undertaken business activities with other market parties in the form of joint ventures and strategic partnerships. Where HEINEKEN does not

have effective control, decisions taken by these entities may not be fully harmonised with HEINEKEN's strategic objectives. Moreover, HEINEKEN may not

be able to identify and manage risks to the same extent as in the rest of the Group.

Risk appetite

The international spread of its business, a robust balance sheet and strong cash flow, as well as a commitment to prudent financial management, form the

context based on which HEINEKEN determines its appetite to risk. A structured risk management process allows HEINEKEN to take risks in a managed and

controlled manner. Key to determining the risk appetite is the nature of the risks:

Strategic: Taking strategic risks is an inherent part of HEINEKEN's entrepreneurial heritage. In its pursuit of balanced growth, HEINEKEN is open to

certain risks linked to its presence in a wide array of developing countries.

Operational: Depending on the type of the operational risk, HEINEKEN is cautious to averse. In particular, ensuring its employees' and contractors'

safety, delivering the highest level of product guality and protecting its reputation have priority over any other business objective.

Reporting: HEINEKEN is averse to any risks that could jeopardise the integrity of its reporting.

Compliance: HEINEKEN is averse to the risk of non-compliance with applicable laws or regulations, as well as with its own Code of Business Conduct.

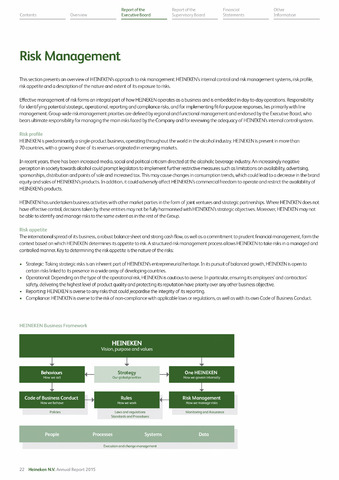

HEINEKEN Business Framework

Strategy

Our global priorities

Rules

How we work

Code of Business Conduct

How we behave

Risk Management

How we manage risks

Behaviours

How we act

One HEINEKEN

How we govern internally

Vision, purpose and values

Policies Laws and regulations Monitoring and Assurance

Standards and Procedures

People Processes Systems Data

Execution and change management

22 Heineken N.V. Annual Report 2015