Notes to the consolidated financial statements continued

Report of the

Report of the

Financial

Other

Contents

Overview

Executive Board

Supervisory Board

statements

information

23. Earnings per share

Basic earnings per share

The calculation of basic earnings per share for the period ended 31 December 2014 is based on the profit attributable to ordinary shareholders

of the Company (net profit) of EUR1,516 million (2013: EUR1.364 million) and a weighted average number of ordinary shares-basic outstanding

during the year ended 31 December 2014 of 574,94 5,645 (2013: 575,062,357). Basic earnings per share for the year amounted to EUR2.64

(2013: EUR2.37).

Diluted earnings per share

The calculation of diluted earnings per share for the period ended 31 December 2014 is based on the profit attributable to ordinary

shareholders of the Company (net profit) of EUR1,516 million (2013: EUR1.364 million) and a weighted average number of ordinary shares

-basic outstanding after adjustment for the effects of all dilutive potential ordinary shares of 576,002,613 (2013: 576,002,613). Diluted

earnings per share for the year amounted to EUR2.63 (2013: EUR2.37).

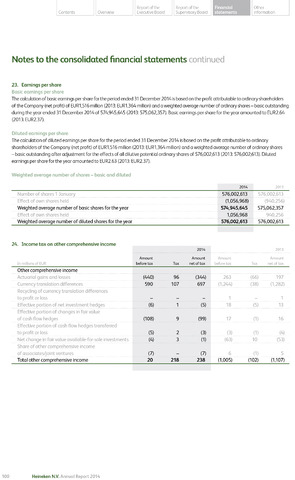

Weighted average number of shares - basic and diluted

2014 2013

576,002,613

Effect of own shares held (1,056,968) (940,256)

Weighted average number of basic shares for the year 574,945,645 575,062,357

Effect of own shares held 1,056,968 940,256

Weighted average number of diluted shares for the year 576,002,613 576,002,613

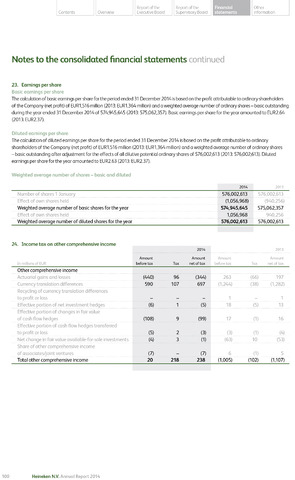

24. Income tax on other comprehensive income

In millions of EUR

2014

2013

Amount Amount

before tax Tax net of tax

Amount Amount

before tax Tax net of tax

Other comprehensive income

Actuarial gains and losses

(440) 96 (344)

263 (66) 197

Currency translation differences

590 107 697

(1,244) (38) (1,282)

Recycling of currency translation differences

to profit or loss

1 - 1

Effective portion of net investment hedges

(6) 1 (5)

18 (5) 13

Effective portion of changes in fair value

of cashflow hedges

(108) 9 (99)

17 (1) 16

Effective portion of cash flow hedges transferred

to profit or loss

(5) 2 (3)

(3) (1) (4)

Net change in fair value available-for-sale investments

(4) 3 (1)

(63) 10 (53)

Share of other comprehensive income

of associates/joint ventures

(7) - (7)

6 (1) 5

Total other comprehensive income

20 218 238

(1,005) (102) (1,107)

100

Heineken N.V. Annual Report 2014