-

-

-

-

Report of the Report of the

Contents Overview Executive Board Supervisory Board

Financial

statements

Other information

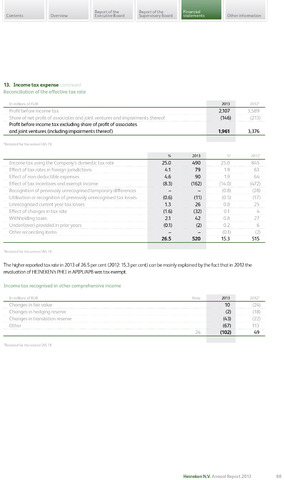

13. Income tax expense

Reconciliation of the effective tax rate

In millions of EUR

2013

2012*

Profit before income tax

2,107

3,589

Share of net profit of associates and joint ventures and impairments thereof

(146)

(213)

Profit before income tax excluding share of profit of associates

and joint ventures (including impairments thereof)

1,961

3,376

*Restated for the revised IAS 19.

2013

2012*

Income tax using the Company's domestic tax rate

25.0

490

25.0

845

Effect of tax rates in foreign jurisdictions

41

79

1.9

63

Effect of non-deductible expenses

46

90

1.9

64

Effect of tax incentives and exempt income

(8.3)

(162)

(14.0)

(472)

Recognition of previously unrecognised temporary differences

(0.8)

(28)

Utilisation or recognition of previously unrecognised tax losses

(0.6)

(11)

(0.5)

(17)

Unrecognised current year tax losses

1.3

26

0.8

25

Effect of changes in tax rate

(1.6)

(32)

0.1

4

Withholding taxes

2.1

42

0.8

27

Undercover) provided in prior years

(0.1)

(2)

0.2

6

Other reconciling items

(0.1)

(2)

26.5

520

15.3

515

*Restated for the revised IAS 19.

The higher reported tax rate in 2013 of 26.5 per cent (2012:15.3 percent) can be mainly explained by the fact that in 2012 the

revaluation of HEINEKEN's PHEI in APIPL/APB was tax exempt.

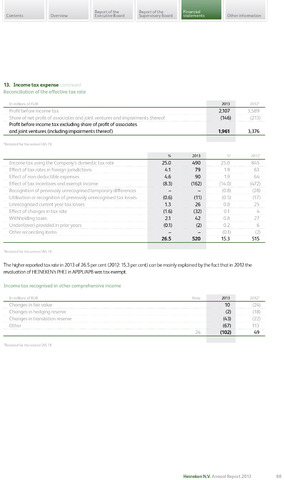

Income tax recognised in other comprehensive income

In millions of EUR

Note

2013

2012*

Changes in fair value

10

(24)

Changes in hedging reserve

(2)

(18)

Changes in translation reserve

(43)

(22)

Other

(67)

113

24

(102)

49

"Restated for the revised IAS 19.

Heineken N.V. Annual Report 2013

88