Report of the Report of the

Contents Overview Executive Board Supervisory Board

Financial

statements

Other information

6. Acquisitions and disposals of subsidiaries and non-controlling interests

Accounting for the acquisition of APIPL/APB

The accounting for the acquisition of Asia Pacific Investment Pte. Ltd ('APIPL') and Asia Pacific Breweries Ltd (APB') and their subsidiaries

(together referred to as the APIPL/APB acquisition') has been finalised on 15 November 2013. Some adjustments were made to the

provisional accounting for the APIPL/APB acquisition, resulting in a decrease in goodwill of EUR37 million. The adjustments mainly

related to the revaluation of P, P E based on additional information obtained about the facts and circumstances that existed at the

acquisition date, which resulted in an increase in P, P E of EUR52 million and an increase in trade and other payables of EUR10 million.

Comparative information has been restated.

In 2012 the APIPL/APB financial figures were consolidated for 1.5 months from 15 November 2012 to year-end. In 2013 the APIPL/

APB financial figures have been consolidated for the full year.

Acquisitions of non-controlling interests

In 2013 HEINEKEN paid a total cash consideration of EUR156 million for the remaining APB shares outstanding in the market as at

31 December 2012. There were no other individually material acquisitions of non-controlling interests during 2013.

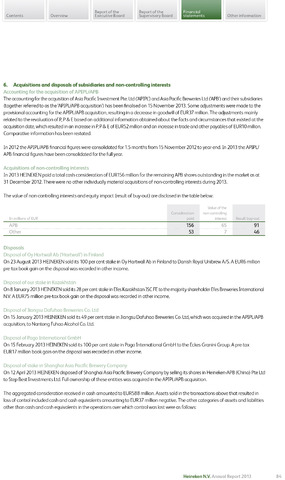

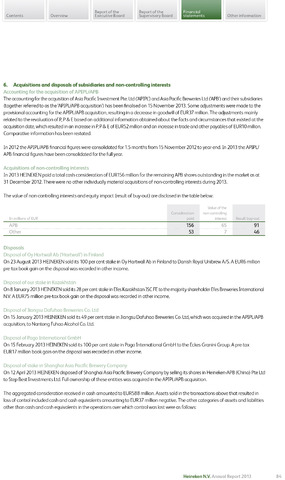

The value of non-controlling interests and equity impact (result of buy-out) are disclosed in the table below:

Value of the

Consideration

non-controlling

In millions of EUR

paid

interest

Result buy-out

APB

156

65

91

53

7

46

Disposals

Disposal of Oy Hartwall Ab ('Hartwall') in Finland

On 23 August 2013 HEINEKEN sold its 100 per cent stake in Oy Hartwall Ab in Finland to Danish Royal UnibrewA/S. A EUR6 million

pre-tax book gain on the disposal was recorded in other income.

Disposal of our stake in Kazakhstan

On 8 January 2013 HEINEKEN sold its 28 per cent stake in Efes Kazakhstan JSC FE to the majority shareholder Efes Breweries International

N.V. A EUR75 million pre-tax book gain on the disposal was recorded in other income.

Disposal of Jiangsu Dafuhao Breweries Co. Ltd

On 15 January 2013 HEINEKEN sold its 49 percent stake in Jiangsu Dafuhao Breweries Co. Ltd, which was acquired in the APIPL/APB

acquisition, to Nantong Fuhao Alcohol Co. Ltd.

Disposal of Pago International GmbH

On 15 February 2013 HEINEKEN sold its 100 per cent stake in Pago International GmbH to the Eckes-Granini Group. A pre-tax

EUR17 million book gain on the disposal was recorded in other income.

Disposal of stake in Shanghai Asia Pacific Brewery Company

On 12 April 2013 HEINEKEN disposed of Shanghai Asia Pacific Brewery Company by selling its shares in Heineken-APB (China) Pte Ltd

to Step Best Investments Ltd. Full ownership of these entities was acquired in the APIPL/APB acquisition.

The aggregated consideration received in cash amounted to EUR588 million. Assets sold in the transactions above that resulted in

loss of control included cash and cash equivalents amounting to EUR37 million negative. The other categories of assets and liabilities

other than cash and cash equivalents in the operations over which control was lost were as follows:

Heineken N.V. Annual Report 2013