-

-

-

-

-

-

-

-

-

-

Report of the Report of the

Contents Overview Executive Board Supervisory Board

Financial

statements

Other information

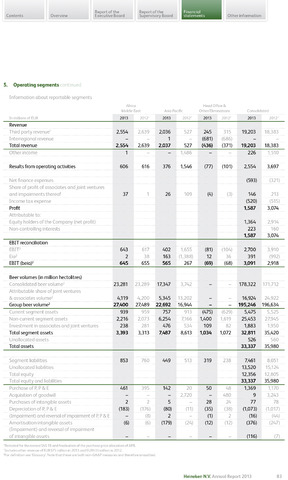

5. Operating segments

Information about reportable segments

Africa Head Office

Middle East Asia Pacific Other/Eliminations Consolidated

In millions of EUR

2013

2012*

2013

2012*

2013

2012*

2013

2012*

Revenue

2,554

2,554

2.036

1

2.037

245

(681)

(436)

19,203

19,203

Third party revenue1

2,639

527

315

18,383

Interregional revenue

(686)

Total revenue

2,639

527

(371)

18,383

Other income

1

1,486

226

1,510

Results from operating activities

606

37

616

376

26

1,546

(77)

(4)

(101)

2,554

(593)

146

(520)

1,587

1,364

3,697

Net finance expenses

(321)

Share of profit of associates and joint ventures

and impairments thereof

1

109

(3)

213

Income tax expense

(515)

Profit

3,074

Attributable to:

Equity holders of the Company (net profit)

2,914

Non-controlling interests

223

160

1,587

3,074

EBIT reconciliation

(81)

12

2,700

391

EBIT2

643

617

402

1,655

(104)

3,910

Eia2

2

38

163

(1,388)

36

(992)

EBIT (beia)2

645

655

565

267

(69)

(68)

3,091

2,918

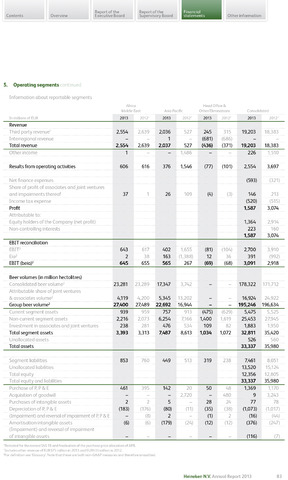

Beer volumes (in million hectolitres)

178,322

16,924

195,246

Consolidated beer volume2

23,281

23,289

17,347

3,742

171,712

Attributable share of joint ventures

associates volume2

4,119

27,400

4,200

5,345

22,692

13,202

24,922

Group beer volume2

27,489

16,944

196,634

Current segment assets

939

959

757

913

(475)

1,400

109

1,034

(629)

5,475

25,453

1,883

32,811

526

33,337

5,525

Non-current segment assets

2,216

2,073

6,254

7,166

1,619

27,945

Investment in associates and joint ventures

238

281

476

7,487

534

82

1,950

Total segment assets

3,393

3,313

8,613

1,072

35,420

Unallocated assets

560

Total assets

35,980

319

Segment liabilities

853

760

449

513

238

7,461

8,051

Unallocated liabilities

13,520

12,356

33,337

15,124

Total equity

12,805

Total equity and liabilities

35,980

Purchase of P, P&E

461

2

(183)

(6)

395

142

5

(80)

2

(179)

20

50

28

(35)

(1)

(12)

48

1,369

9

77

(1,073)

(16)

(376)

(116)

1,170

Acquisition of goodwill

2,720

480

3,243

Purchases of intangible assets

2

24

78

Depreciation of P, P E

(176)

(11)

(38)

(1,017)

(Impairment) and reversal of impairment of P, P E

(8)

2

(44)

Amortisation intangible assets

(6)

(24)

(12)

(247)

(Impairment) and reversal of impairment

of intangible assets

(7)

*Restated for the revised IAS 19 and finalisation of the purchase price allocation of APB.

includes other revenue of EUR375 million in 2013 and EUR433 million in 2012.

2For definition see 'Glossary'. Note that these are both non-GAAP measures and therefore unaudited.

Heineken N.V. Annual Report 2013

83