Remuneration Report continued

Report of the

1 Report of the

Financial

Contents

Overview

Executive Board

Supervisory Board

statements

Other information

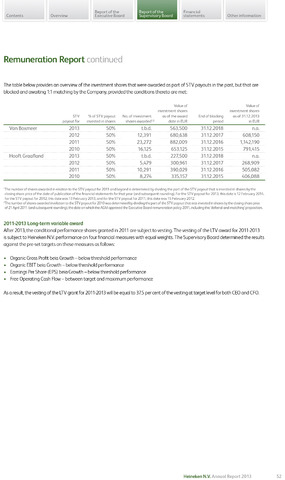

The table below provides an overview of the investment shares that were awarded as part of STV payouts in the past, but that are

blocked and awaiting 1:1 matching by the Company, provided the conditions thereto are met:

STV

payout for

of ST V payout

invested in shares

No. of investment

shares awarded1-2

Value of

investment shares

as of the award

date in EUR

End of blocking

period

Value of

investment shares

as of 31.12.2013

in EUR

Van Boxmeer

2013

50%

t.b.d.

563,500

31.12.2018

n.a.

2012

50%

12,391

680,638

31.12.2017

608,150

2011

50%

23,272

882,009

31.12.2016

1,142,190

2010

50%

16,125

653,125

31.12.2015

791,415

Hooft Graafland

2013

50%

t.b.d.

227,500

31.12.2018

n.a.

2012

50%

5,479

300,961

31.12.2017

268,909

2011

50%

10,291

390,029

31.12.2016

505,082

2010

50%

8,274

335,157

31.12.2015

406,088

1The number of shares awarded in relation to the STV payout for 2011 and beyond is determined by dividing the part of the STV payout that is invested in shares by the

closing share price of the date of publication of the financial statements for that year (and subsequent rounding). For the STV payout for 2013, this date is 12 February 2014,

for the STV payout for 2012, this date was 13 February 2013, and for the STV payout for 2011this date was 15 February 2012.

2The number of shares awarded in relation to the STV payout for 2010 was determined by dividing the part of the STV payout that was invested in shares by the closing share price

of 21 April 2011 (and subsequent rounding), the date on which the AGM approved the Executive Board remuneration policy 2011including this 'deferral-and-matching' proposition.

2011-2013 Long-term variable award

After 2013, the conditional performance shares granted in 2011 are subject to vesting. The vesting of the LTV award for 2011-2013

is subject to Heineken N.V. performance on four financial measures with egual weights. The Supervisory Board determined the results

against the pre-set targets on these measures as follows:

Organic Gross Profit beia Growth - below threshold performance

Organic EBIT beia Growth - below threshold performance

Earnings Per Share (EPS) beia Growth-below threshold performance

Free Operating Cash Flow-between target and maximum performance

As a result, the vesting of the LTV grant for 2011-2013 will be egual to 37.5 percent of the vesting at target level for both CEO and CFO.

Heineken N.V. Annual Report 2013

52