Contents

Overview

Report of the

Executive Board

Report of the

Supervisory Board

Financial

statements

Other information

The vested performance shares that remain after income tax withholding are subject to an additional holding restriction of two years.

Pensions

The members of the Executive Board can either participate in a Defined Contribution Pension Plan or in a Capital Creation Plan.

In the Capital Creation Plan, the Executive Board member elects to receive as taxable income the contribution amounts from the

Defined Contribution Pension Plan, less an amount eguivalent to the employee contribution in that plan. Both CEO and CFO

participate in the Capital Creation Plan.

As from 2012, the Defined Contribution Pension Plan and the Capital Creation Plan for Executive Board members have been fully

aligned with the corresponding plans for the Top Executives under Dutch employment contract below the Executive Board. Since the

latter plans have been amended as a result of legislative changes as from 2014, the Supervisory Board has decided to amend the

Executive Board's Capital Creation Plan accordingly, implying a reduction of pension contribution rates by around 11-13 per cent.

Loans

HEINEKEN does not provide loans to the members of the Executive Board.

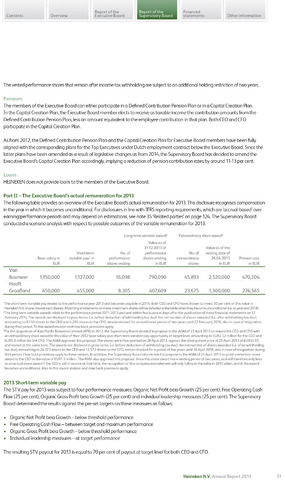

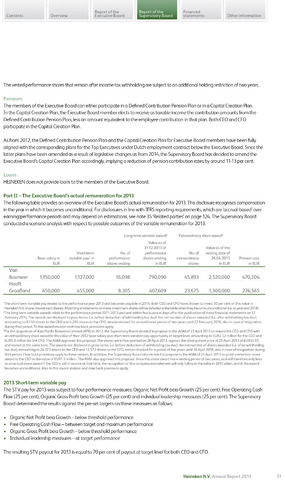

Part II -The Executive Board's actual remuneration for 2013

The following table provides an overview of the Executive Board's actual remuneration for 2013. This disclosure recognises compensation

in the year in which it becomes unconditional. For disclosures in line with IFRS reporting reguirements, which are 'accrual-based' over

earning/performance periods and may depend on estimations, see note 35 'Related parties' on page 124. The Supervisory Board

conducted a scenario analysis with respect to possible outcomes of the variable remuneration for 2013.

Short-term

Base salary in variable pay1 in

EUR EUR

No. of

performance

shares vesting

Long-term variable award2

Value as of

31.12.2013 of

performance

shares vesting

in EUR

Extraordinary share award3

Value as of the

No. of vesting date of

extraordinary 26.04.2013 Pension cost

shares in EUR in EUR

Van

Boxmeer 1,150,000 1,127,000 16,098 790,090

Hooft

Graafland 650,000 455,000 8,305 407,609

45,893 2,520,000 470,204

23,675 1,300,000 276,565

1The short-term variable pay relates to the performance year 2013 and becomes payable in 2014. Both CEO and CFO have chosen to invest 50 per cent of this value in

Heineken N.V. shares (investment shares). Matching entitlements on these investment shares will be included in the table when they become unconditional (i.e. at year-end 2018)

2The long-term variable awards relate to the performance period 2011-2013 and vest within five business days after the publication of these financial statements on 12

February 2014. The awards are disclosed in gross terms (i.e. before deduction of withholding tax due); the net number of shares awarded (i.e. after withholding tax due),

amounting to 8,150 shares to the CEO and 4,205 shares to the CFO, remain blocked for an additional period of two years until 22 February 2016, also in case of resignation

during that period. To this award revision and claw back provisions apply.

3For the acquisition of Asia Pacific Breweries Limited (APB) in 2012, the Supervisory Board decided to propose to the AGM of 25 April 2013 to reward the CEO and CFO with

an extraordinary share award to the value of their 2012 base salary plus short-term variable pay opportunity at target level, amounting to EUR2.52 million for the CEO and

EUR1.3 million for the CFO. The AGM approved this proposal. The shares were thus granted on 26 April 2013, against the closing share price of 25 April 2013 of EUR54.91,

and vested at the same time. The awards are disclosed in gross terms (i.e. before deduction of withholding tax due); the net number of shares awarded (i.e. after withholding

tax due), amounting to 24,373 shares to the CEO and 12,573 shares to the CFO, remain blocked for a period of five years until 26 April 2018, also incase of resignation during

that period. Claw back provisions apply to these awards. In addition, the Supervisory Board also decided to propose to the AGM of 25 April 2013 to grant a retention share

award to the CEO to the value of EUR1.5 million. The AGM also approved this proposal. Since this share award has a vesting period of two years, and will therefore only lead

to an actual share award if the CEO is still in service at that time, the recognition of this compensation element will only follow in the table in 2015 when, and if, the award

becomes unconditional. Also to this award revision and claw back provisions apply.

2013 Short-term variable pay

The STV pay for 2013 was subject to four performance measures: Organic Net Profit beia Growth (25 percent), Free Operating Cash

Flow (25 per cent), Organic Gross Profit beia Growth (25 per cent) and individual leadership measures (25 per cent). The Supervisory

Board determined the results against the pre-set targets on these measures as follows:

Organic Net Profit beia Growth - below threshold performance

Free Operating Cash Flow-between target and maximum performance

Organic Gross Profit beia Growth - below threshold performance

Individual leadership measures-at target performance

The resulting STV payout for 2013 is egual to 70 per cent of payout at target level for both CEO and CFO.

Heineken N.V. Annual Report 2013

51