Financial Review

Contents

Overview

Report of the

Executive Board

Report of the

Supervisory Board

Financial

statements

Other information

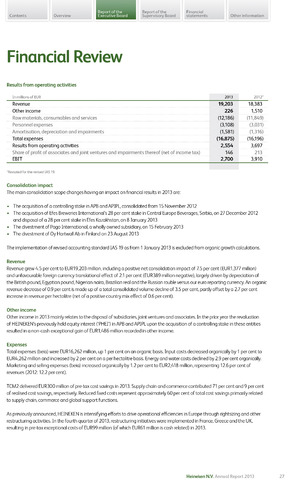

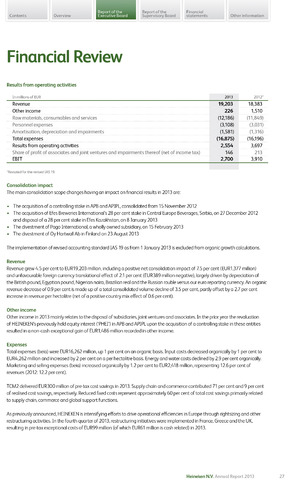

Results from operating activities

In millions of EUR

2013

2012*

Revenue

19,203

18,383

Other income

226

1,510

Raw materials, consumables and services

(12,186)

(11,849)

Personnel expenses

(3,108)

(3,031)

Amortisation, depreciation and impairments

(1,581)

(1,316)

Total expenses

(16,875)

(16,196)

Results from operating activities

2,554

3,697

Share of profit of associates and joint ventures and impairments thereof (net of income tax)

146

213

EBIT

2,700

3,910

*Restated for the revised IAS 19.

Consolidation impact

The main consolidation scope changes having an impact on financial results in 2013 are:

The acguisition of a controlling stake in APB and APIPL, consolidated from 15 November 2012

The acguisition of Efes Breweries International's 28 per cent stake in Central Europe Beverages, Serbia, on 27 December 2012

and disposal of a 28 per cent stake in Efes Kazakhstan, on 8 January 2013

The divestment of Pago International, a wholly owned subsidiary, on 15 February 2013

The divestment of Oy Hartwall Ab in Finland on 23 August 2013

The implementation of revised accounting standard IAS 19 as from 1 January 2013 is excluded from organic growth calculations.

Revenue

Revenue grew 45 per cent to EUR19,203 million, including a positive net consolidation impact of 7.5 per cent (EUR1,377 million)

and unfavourable foreign currency translational effect of 2.1 per cent (EUR389 million negative), largely driven by depreciation of

the British pound, Egyptian pound, Nigerian naira, Brazilian real and the Russian rouble versus our euro reporting currency. An organic

revenue decrease of 0.9 percent is made up of a total consolidated volume decline of 3.5 per cent, partly offset by a 2.7 per cent

increase in revenue per hectolitre (net of a positive country mix effect of 0.5 per cent).

Other income

Other income in 2013 mainly relates to the disposal of subsidiaries, joint ventures and associates. In the prior year the revaluation

ofHEINEKEN's previously held eguity interest ('PHEI') in APB and APIPL upon the acguisition of a controlling stake in these entities

resulted in a non-cash exceptional gain of EUR1,486 million recorded in other income.

Expenses

Total expenses (beia) were EUR16,262 million, up 1 per cent on an organic basis. Input costs decreased organically by 1 per cent to

EUR4.262 million and increased by 2 per cent on a per hectolitre basis. Energy and water costs declined by 2.9 per cent organically.

Marketing and selling expenses (beia) increased organically by 1.2 per cent to EUR2,418 million, representing 12.6 per cent of

revenues (2012:12.2 percent).

TCM2 delivered EUR300 million of pre-tax cost savings in 2013. Supply chain and commerce contributed 71 per cent and 9 percent

of realised cost savings, respectively. Reduced fixed costs represent approximately 60 per cent of total cost savings primarily related

to supply chain, commerce and global support functions.

As previously announced, HEINEKEN is intensifying efforts to drive operational efficiencies in Europe through rightsizing and other

restructuring activities. In the fourth guarter of 2013, restructuring initiatives were implemented in France, Greece and the UK,

resulting in pre-tax exceptional costs of EUR99 million (of which EUR61 million is cash related) in 2013.

Heineken N.V. Annual Report 2013

27