-

Report of the Report of the

Contents Overview Executive Board Supervisory Board

Financial

statements

Other information

Level 2

HEINEKEN determines level 2 fair values for over-the-counter securities based on broker quotes. The fair values of simple over-the-

counter derivative financial instruments are determined by using valuation techniques. These valuation techniques maximise the use

of observable market data where available.

The fair value of derivatives is calculated as the present value of the estimated future cash flows based on observable interest yield

curves, basis spread and foreign exchange rates. These calculations are tested for reasonableness by comparing the outcome of the

internal valuation with the valuation received from the counterparty. Fair values reflect the credit risk of the instrument and include

adjustments to take into account the credit risk of HEINEKEN and counterparty when appropriate.

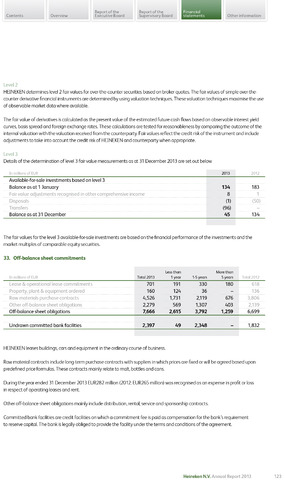

Level 3

Details of the determination of level 3 fair value measurements as at 31 December 2013 are set out below

In millions of EUR

2013

2012

Available-for-sale investments based on level 3

Balance as at 1 January

134

183

Fair value adjustments recognised in other comprehensive income

8

1

Disposals

(1)

(50)

Transfers

(96)

Balance as at 31 December

45

134

The fair values for the level 3 available-for-sale investments are based on the financial performance of the investments and the

market multiples of comparable equity securities.

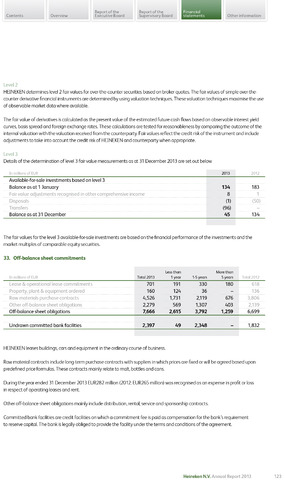

33. Off-balance sheet commitments

In millions of EUR

Total 2013

Less than

1 year

1-5 years

More than

5 years

Total 2012

Lease operational lease commitments

701

191

330

180

618

Property, plant equipment ordered

160

124

36

136

Raw materials purchase contracts

4,526

1,731

2,119

676

3,806

Other off-balance sheet obligations

2,279

569

1,307

403

2,139

Off-balance sheet obligations

7,666

2,615

3,792

1,259

6,699

Undrawn committed bank facilities

2,397

49

2,348

1,832

HEINEKEN leases buildings, cars and equipment in the ordinary course of business.

Raw material contracts include long-term purchase contracts with suppliers in which prices are fixed or will be agreed based upon

predefined price formulas. These contracts mainly relate to malt, bottles and cans.

During the year ended 31 December 2013 EUR282 million (2012: EUR265 million) was recognised as an expense in profit or loss

in respect of operating leases and rent.

Other off-balance sheet obligations mainly include distribution, rental, service and sponsorship contracts.

Committed bank facilities are credit facilities on which a commitment fee is paid as compensation for the bank's requirement

to reserve capital. The bank is legally obliged to provide the facility under the terms and conditions of the agreement.

Heineken N.V. Annual Report 2013

123