-

-

-

-

-

-

-

-

-

-

-

-

Report of the Report of the

Contents Overview Executive Board Supervisory Board

Financial

statements

Other information

32. Financial risk management and financial instruments

Recent times have proven the credit markets situation could be such that it is difficult to generate capital to finance long-term growth

of HEINEKEN. Although currently the situation is more stable, HEINEKEN has a clear focus on ensuring sufficient access to capital

markets to finance long-term growth and to refinance maturing debt obligations. Financing strategies are under continuous evaluation.

In addition, HEINEKEN focuses on a further fine-tuning of the maturity profile of its long-term debts with its forecast operating

cash flows. Strong cost and cash management and controls over investment proposals are in place to ensure effective and efficient

allocation of financial resources.

Contractual maturities

The following are the contractual maturities of non-derivative financial liabilities and derivative financial assets and liabilities,

including interest payments and excluding the impact of netting agreements:

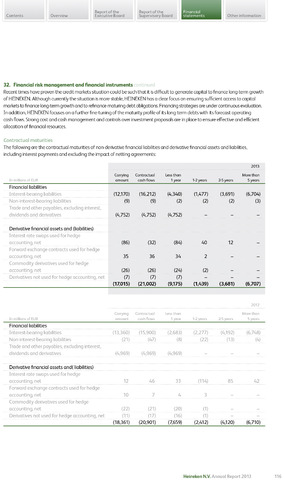

2013

In millions of EUR

Carrying

amount

Contractual

cash flows

Less than

1 year

1 -2 years

2-5 years

More than

5 years

Financial liabilities

Interest-bearing liabilities

(12,170)

(16,212)

(A.3A0)

(1.A77)

(3,691)

(6.70A)

Non-interest-bearing liabilities

(9)

(9)

(2)

(2)

(2)

(3)

Trade and other payables, excluding interest,

dividends and derivatives

(A,752)

(A,752)

(A,752)

Derivative financial assets and (liabilities)

Interest rate swaps used for hedge

accounting, net

(86)

(32)

(8A)

AO

12

Forward exchange contracts used for hedge

accounting, net

35

36

3A

2

Commodity derivatives used for hedge

accounting, net

(26)

(26)

(2A)

(2)

Derivatives not used for hedge accounting, net

(7)

(7)

(7)

(17,015)

(21,002)

(9,175)

(1.A39)

(3,681)

(6,707)

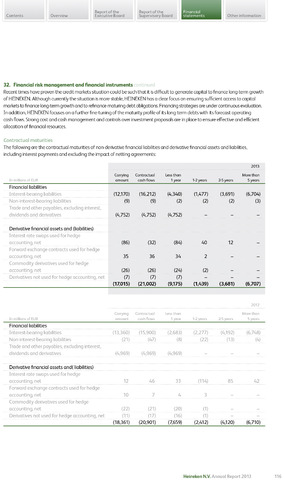

2012

In millions of EUR

Carrying

amount

Contractual

cash flows

Less than

1 year

1 -2 years

2-5 years

More than

5 years

Financial liabilities

Interest-bearing liabilities

(13,360)

(15,900)

(2,683)

(2,277)

(A,192)

(6.7A8)

Non-interest-bearing liabilities

(21)

(A7)

(8)

(22)

(13)

(A)

Trade and other payables, excluding interest,

dividends and derivatives

(A ,9 69)

(A ,9 69)

(A ,9 69)

Derivative financial assets and( liabilities)

Interest rate swaps used for hedge

accounting, net

12

A6

33

(11 A)

85

A2

Forward exchange contracts used for hedge

accounting, net

10

7

A

3

Commodity derivatives used for hedge

accounting, net

(22)

(21)

(20)

(1)

Derivatives not used for hedge accounting, net

(11)

(17)

(16)

(1)

(18,361)

(20,901)

(7,659)

(2.A12)

(A,120)

(6,710)

Heineken N.V. Annual Report 2013

116