Overview

Report of the

Executive Board

Report of the

Supervisory Board

Financial statements

Other information

The exceptional items in the tax expense are EUR53 million (2011: EUR47 million) related to acquisition related intangibles and the remainder

of EUR2 million represents the net impact of other exceptional items included in EBIT and finance cost.

EBIT and EBIT (beia) are not financial measures calculated in accordance with IFRS. The presentation on these financial measures may

not be comparable to similarly titled measures reported by other companies due to differences in the ways the measures are calculated.

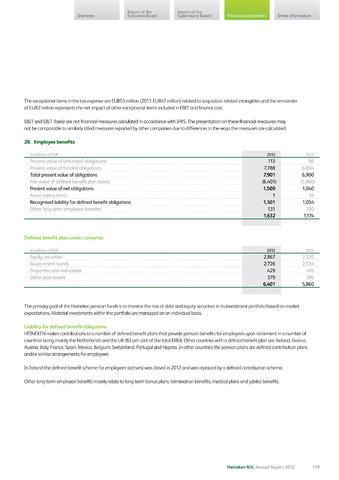

28. Employee benefits

2012

Present value of unfunded obligations

113

96

Present value of funded obligations

7,788

6,804

Total present value of obligations

7,901

6,900

Fair value of defined benefit plan assets

(6,401)

(5,860)

Present value of net obligations

1,500

1,040

Asset ceiling items

1

14

Recognised liability for defined benefit obligations

1,501

1,054

Other long-term employee benefits

131

120

1,632

1,174

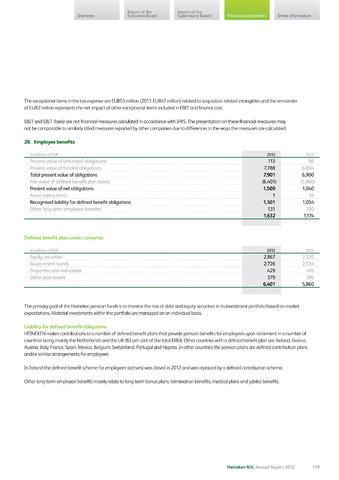

Defined benefit plan assets comprise:

2012

Equity securities

2,867

2,520

Government bonds

2,726

2,534

Properties and real estate

429

410

Other plan assets

379

396

6,4015,860

The primary goal of the Heineken pension funds is to monitor the mix of debt and equity securities in its investment portfolio based on market

expectations. Material investments within the portfolio are managed on an individual basis.

Liability for defined benefit obligations

HEINEKEN makes contributions to a number of defined benefit plans that provide pension benefits for employees upon retirement in a number of

countries being mainly the Netherlands and the UK (82 per cent of the total DBO). Other countries with a defined benefit plan are: Ireland, Greece,

Austria, Italy, France, Spain, Mexico, Belgium, Switzerland, Portugal and Nigeria. In other countries the pension plans are defined contribution plans

and/or similar arrangements for employees.

In Ireland the defined benefit scheme for employees (actives) was closed in 2012 and was replaced by a defined contribution scheme.

Other long-term employee benefits mainly relate to long-term bonus plans, termination benefits, medical plans and jubilee benefits.

Heineken N.V. Annual Report 2012

119