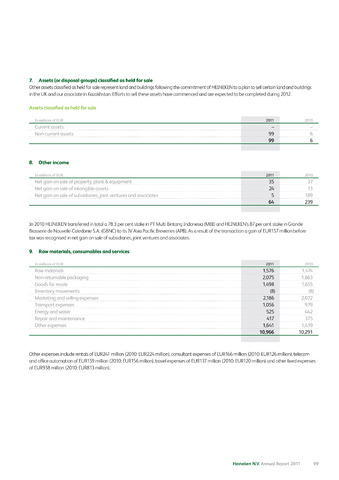

7. Assets (or disposal groups) classified as held for sale

Other assets classified as held for sale represent land and buildings following the commitment of H EINEKEN to a plan to sell certain land and buildings

in the UK and our associate in Kazakhstan. Efforts to sell these assets have commenced and are expected to be completed during 2012.

Assets classified as held for sale

2011

Current assets

-

-

Non-current assets

99

6

99

6

8. Other income

2011

Net gain on sale of property, plant equipment

35

37

Net gain on sale of intangible assets

24

13

Net gain on sale of subsidiaries, joint ventures and associates

5

189

64

239

In 2010 EIEINEKEN transferred in total a 78.3 per cent stake in PT Multi Bintang Indonesia (MBI) and HEINEKEN's87 per cent stake in Grande

Brasserie de Nouvelle-Caledonie S.A. (GBNC) to its IV Asia Pacific Breweries (APB). As a result of the transaction a gain of EUR157 million before

tax was recognised in net gain on sale of subsidiaries, joint ventures and associates.

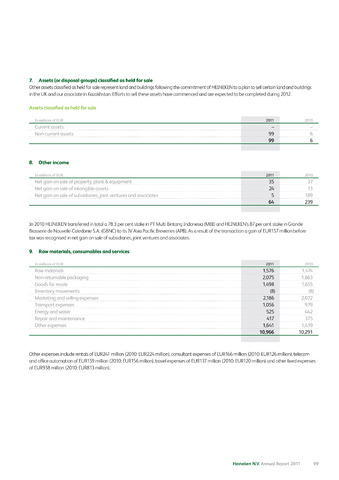

9. Raw materials, consumables and services

2011

Raw materials

1,576

1,474

Non-returnable packaging

2,075

1,863

Goods for resale

1,498

1,655

Inventory movements

(8)

(8)

Marketing and selling expenses

2,186

2,072

Transport expenses

1,056

979

Energy and water

525

442

Repair and maintenance

417

375

Other expenses

1,641

1,439

10,966

10,291

Other expenses include rentals of EUR241 million (2010: EUR224 million), consultant expenses of EUR166 million (2010: EUR126 million), telecom

and office automation of EUR159 million (2010: EUR156 million), travel expenses of EUR137 million (2010: EUR120 million) and other fixed expenses

of EUR938 million (2010: EUR813 million).

Heineken N.V. Annual Report 2011

99