102

Financial statements Notes to the consolidated financial statements

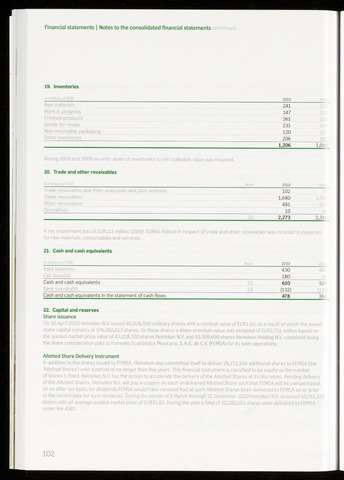

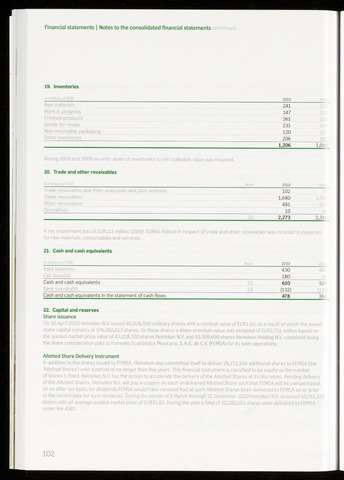

19. Inventories

2010

Raw materials

241

17

Work in progress

147

132

Finished products

261

140

Goods for resale

231

Non-returnable packaging

120

107

Other inventories

206

192

1,206

1,010

During 2010 and 2009 no write-down of inventories to net realisable value was required.

20. Trade and other receivables

In millions of EUR

2010

Trade receivables due from associates and joint ventures

102

Trade receivables

1,680

1,730

Other receivables

481

453

Derivatives

10

2,273

2,310

A net impairment loss of EUR115 million (2009: EUR64 million) in respect of trade and other receivables was included in expenses

for raw materials, consumables and services.

21. Cash and cash equivalents

2010

Bank balances

430

482

Call deposits

180

Cash and cash equivalents

32

610

520

Bank overdrafts

(132)

(156)

Cash and cash equivalents in the statement of cash flows

478

364

22. Capital and reserves

Share issuance

On 30 April 2010 Heineken N.V. issued 86,028,019 ordinary shares with a nominal value of EUR1.60, as a result of which the issued

share capital consists of 576,002,613 shares. To these shares a share premium value was assigned of EUR2.701 million based on

the quoted market price value of 43,018,320 shares Heineken N.V. and 43,009,699 shares Heineken Holding N.V. combined being

the share consideration paid to Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA) for its beer operations.

Allotted Share Delivery Instrument

In addition to the shares issued to FEMSA, Heineken also committed itself to deliver 29,172,504 additional shares to FEMSA (the

'Allotted Shares') over a period of no longer than five years. This financial instrument is classified to be equity as the number

of shares is fixed. Heineken N.V. has the option to accelerate the delivery of the Allotted Shares at its discretion. Pending delivery

of the Allotted Shares, Heineken N.V. will pay a coupon on each undelivered Allotted Share such that FEMSA will be compensated,

on an after tax basis, for dividends FEMSA would have received had all such Allotted Shares been delivered to FEMSA on or prior

to the record date for such dividends. During the period of 8 March through 31 December 2010 Heineken N.V. acquired 10,765,258

shares with an average quoted market price of EUR35.85. During the year a total of 10,240,553 shares were delivered to FEMSA

under the ASDI.