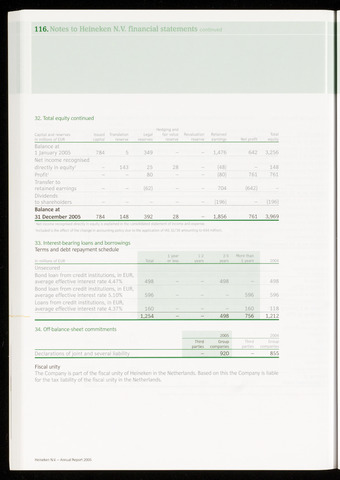

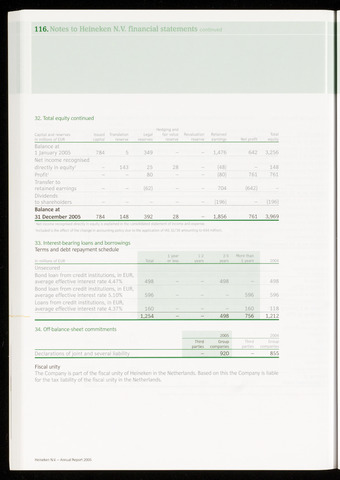

116. Notes to Heineken N.V. financial statements continued

32. Total equity continued

Capital and reserves

In millions of EUR

Issued Translation

capital

Hedging and

Legal fair value Revaluation Retained

reserves reserve reserve earnings

Net profit

Total

equity

Balance at

1 January 2005 784 5

349

1,476

642

3,256

Net income recognised

directly in equity1 - 143

25

28

(48)

148

Profit2

80

(80)

761

761

Transfer to

retained earnings -

(62)

704

(642)

Dividends

to shareholders

(196)

(196)

Balance at

31 December 2005 784 148

392

28

1,856

761

3,969

Net income recognised directly in equity is explained in the consolidated statement of income and expense.

2 Included is the effect of the change in accounting policy due to the application of IAS 32/39 amounting to €44 million).

33. Interest-bearing loans and borrowings

Terms and debt repayment schedule

In millions of EUR

Total

1 year

or less

1-2

years

2-5

years

More than

2004

Unsecured

Bond loan from credit institutions, in EUR,

average effective interest rate 4.47%

498

498

498

Bond loan from credit institutions, in EUR,

average effective interest rate 5.10%

596

596

596

Loans from credit institutions, in EUR,

average effective interest rate 4.37%

160

160

118

1,254

-

-

498

756

1,212

34. Off-balance-sheet commitments

2005

2004

Third

parties

Group

companies

Third

parties

Group

companies

Declarations of joint e

-

920

855

Fiscal unity

The Company is part of the fiscal unity of Heineken in the Netherlands. Based on this the Company is liable

for the tax liability of the fiscal unity in the Netherlands.

Heineken N.V. - Annual Report 2005