91 Heineken N.V. Annual Report 2004 Financial Statements 2004 Notes to the Consolidated Balance Sheet

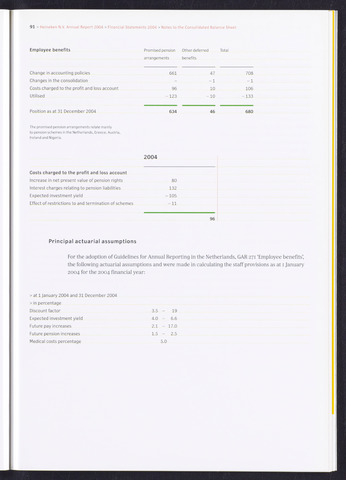

Employee benefits Promised pension Other deferred Total

arrangements benefits

Change in accounting policies

661

47

708

Changes in the consolidation

-

-1

-1

Costs charged to the profit and loss account

96

10

106

Utilised

-123

-10

-133

Position as at 31 December 2004

634

46

680

The promised pension arrangements relate mainly

to pension schemes in the Netherlands, Greece, Austria,

Ireland and Nigeria.

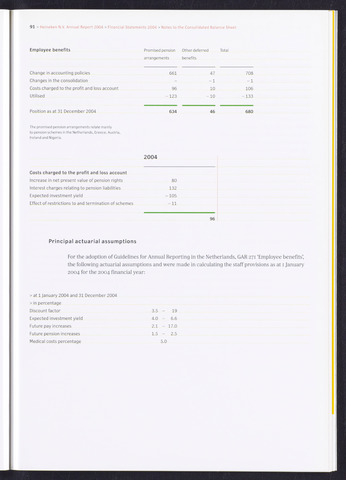

2004

Costs charged to the profit and loss account

Increase in net present value of pension rights

80

Interest charges relating to pension liabilities

132

Expected investment yield

-105

Effect of restrictions to and termination of schemes

-11

96

Principal actuarial assumptions

For the adoption of Guidelines for Annual Reporting in the Netherlands, GAR 271 'Employee benefits',

the following actuarial assumptions and were made in calculating the staff provisions as at 1 January

2004 for the 2004 financial year:

at 1 January 2004 and 31 December 2004

in percentage

Discount factor

3.5

- 19

Expected investment yield

4.0

- 6.6

Future pay increases

2.1

- 17.0

Future pension increases

1.5

- 2.5

Medical costs percentage

5.0