73 Heineken N.V. Annual Report 2004 Report of the Executive Board Financial Review

2004

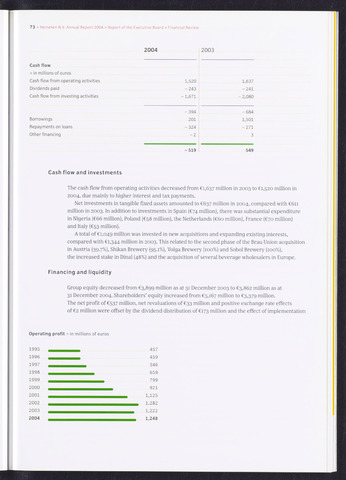

Cash flow

in millions of euros

Cash flow from operating activities

Dividends paid

Cash flow from investing activities

Borrowings

Repayments on loans

Other financing

1,520

-243

-1,671

-394

201

-324

-2

-519

2003

1,637

-241

-2,080

-684

1,501

-271

3

549

Cash flow and investments

The cash flow from operating activities decreased from €1,637 million in 2003 to €1,520 million in

2004, due mainly to higher interest and tax payments.

Net investments in tangible fixed assets amounted to €637 million in 2004, compared with €611

million in 2003. In addition to investments in Spain (€74 million), there was substantial expenditure

in Nigeria (€66 million), Poland (€58 million), the Netherlands (€60 million), France (€70 million)

and Italy (€53 million).

A total of €1,049 million was invested in new acquisitions and expanding existing interests,

compared with €1,344 million in 2003. This related to the second phase of the Brau Union acquisition

in Austria (39.7%), Shikan Brewery (95.1%), Volga Brewery (100%) and Sobol Brewery (100%),

the increased stake in Dinal (48%) and the acquisition of several beverage wholesalers in Europe.

Financing and liquidity

Group equity decreased from €3,899 million as at 31 December 2003 to €3,862 million as at

31 December 2004. Shareholders' equity increased from €3,167 million to €3,379 million.

The net profit of €537 million, net revaluations of €33 million and positive exchange rate effects

of €2 million were offset by the dividend distribution of €173 million and the effect of implementation

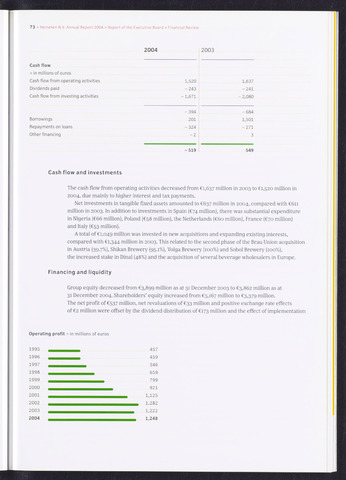

Operating profit in millions of euros

1995 457

1996 459

1997 546

1998 659

1999 799

2000 921

2001 1>125

2002 ammmm1,282

2003 1,222

2004 1,248