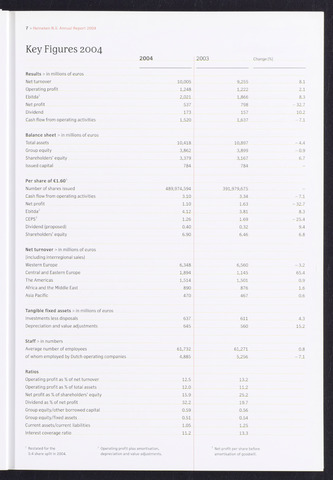

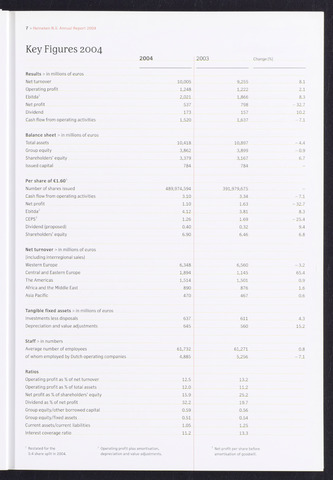

Key Figures 2004

7 Heineken N.V. Annual Report 2004

2004

Results in millions of euros

Net turnover

10,005

9,255

8.1

Operating profit

1,248

1,222

2.1

Ebitda'

2,021

1,866

8.3

Net profit

537

798

-32.7

Dividend

173

157

10.2

Cash flow from operating activities

1,520

1,637

-7.1

Balance sheet in millions of euros

Total assets

10,418

10,897

-4.4

Group equity

3,862

3,899

-0.9

Shareholders' equity

3,379

3,167

6.7

Issued capital

784

784

Per share of C1.601

Number of shares issued

489,974,594

391,979,675

Cash flow from operating activities

3.10

3.34

-7.1

Net profit

1.10

1.63

-32.7

Ebitda2

4.12

3.81

8.3

CEPS3

1.26

1.69

-25.4

Dividend (proposed)

0.40

0.32

9.4

Shareholders' equity

6.90

6.46

6.8

Net turnover in millions of euros

(including interregional sales)

Western Europe

6,348

6,560

-3.2

Central and Eastern Europe

1,894

1,145

65.4

The Americas

1,514

1,501

0.9

Africa and the Middle East

890

876

1.6

Asia Pacific

470

467

0.6

Tangible fixed assets in millions of euros

Investments less disposals

637

611

4.3

Depreciation and value adjustments

645

560

15.2

Staff in numbers

Average number of employees

61,732

61,271

0.8

of whom employed by Dutch operating companies

4,885

5,256

-7.1

Ratios

Operating profit as of net turnover

12.5

13.2

Operating profit as of total assets

12.0

11.2

Net profit as of shareholders' equity

15.9

25.2

Dividend as of net profit

32.2

19.7

Group equity/other borrowed capital

0.59

0.56

Group equity/fixed assets

0.51

0.54

Current assets/current liabilities

1.05

1.25

Interest coverage ratio

11.2

13.3

2003

Change

1 Restated for the

5:4 share split in 2004.

2 Operating profit plus amortisation,

depreciation and value adjustments.

3 Net profit per share before

amortisation of goodwill.