2001

2001 2000

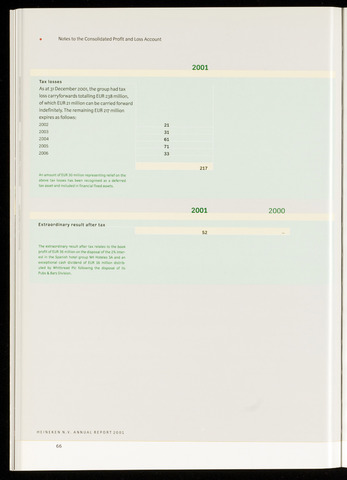

Notes to the Consolidated Profit and Loss Account

Tax losses

As at 31 December 2001, the group had tax

loss carryforwards totalling EUR 238 million,

of which EUR 21 million can be carried forward

indefinitely. The remaining EUR 217 million

expires as follows:

2002 21

2003 31

2004 61

2005 71

2006 33

217

An amount of EUR 30 million representing relief on the

above tax losses has been recognised as a deferred

tax asset and included in financial fixed assets.

Extraordinary result after tax

52

The extraordinary result after tax relates to the book

profit of EUR 36 million on the disposal of the 2% inter

est in the Spanish hotel group NH Hoteles SA and an

exceptional cash dividend of EUR 16 million distrib

uted by Whitbread Pic following the disposal of its

Pubs Bars Division.

HEINEKEN N.V. ANNUAL REPORT 2001

66