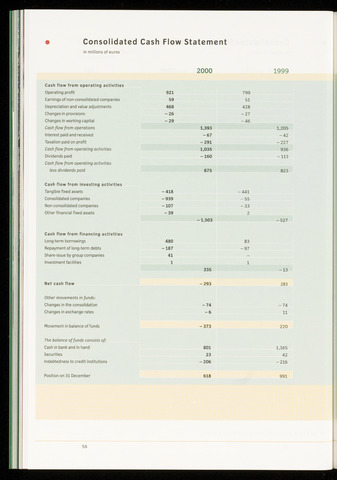

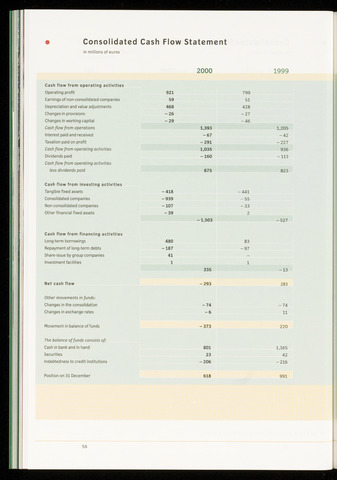

Consolidated Cash Flow Statement

2000 1999

in millions of euros

Cash flow from operating activities

Operating profit

Earnings of non-consolidated companies

Depreciation and value adjustments

Changes in provisions

Changes in working capital

Cash flow from operations

Interest paid and received

Taxation paid on profit

Cash flow from operating activities

Dividends paid

Cash flow from operating activities

less dividends paid

Cash flow from investing activities

Tangible fixed assets

Consolidated companies

Non-consolidated companies

Other financial fixed assets

Cash flow from financing activities

Long-term borrowings

Repayment of long-term debts

Share-issue by group companies

Investment facilities

Net cash flow

Other movements in funds:

Changes in the consolidation

Changes in exchange rates

Movement in balance of funds

The balance of funds consists of:

Cash in bank and in hand

Securities

Indebtedness to credit institutions

Position on 31 December

921 799

59 51

468 428

-26 -27

- 29 - 46

1,393 1,205

- 67 - 42

-291 -227

1,035 936

- 160 -113

875 823

-418

-939

-107

-39

-1,503

-441

-55

-33

2

527

480

-187

41

1

335

-293

83

-97

13

283

-74

-6

-373

-74

11

220

801

23

-206

618

1,165

42

-216

991

56