Personnel costs rose as a result of new consolida

tions and higher labour costs. The allocations to

the provisions for personnel schemes were down

on 1998. Additional depreciation on the other

hand was higher in 1999. principally in Africa and

the Asia Pacific region, and as a result of the

accelerated depreciation of packaging materials

in Central Europe.

Excise duties were 20% higher in connection

with the high rates at the newly consolidated

Polish breweries.

Operating profit and net profit

Operating profit increased by 21% to EUR 799

million. The increase in sales and improvement

in the sales mix and selling prices accounted

for more than half of this. New consolidations

also contributed to the higher operating profit.

The impact of changes in exchange rates was

of minor importance. Expressed as a percentage

of net turnover, operating profit increased from

10.5% to 11.2%.

In spite of non-recurring book profits from

sales of participations in 1998, earnings from non-

consolidated participations increased in 1999.

This was especially attributable to the positive

developments at Nigerian Breweries, in which

we increased our participation to 40.7%.

The higher amount of interest paid was due

mainly to the financing of acquisitions and the

interest charges of the new Polish companies

included in the consolidation. Interest cover was 21.

The tax burden fell from 36.2% in 1998 to

34.9% in 1999, mainly as a result of tax losses

being carried forward in Spain and Switzerland

and a lower tax burden in Ireland.

The minority interest in the result increased,

reflecting the improvement in results in Spain

and Indonesia.

Net profit rose by 16% to EUR 516 million.

The net profit per share of NLG 5.00 par value

(EUR 2.27) rose from EUR 1.42 to EUR 1.65.

Cash flow and investments

Cash flow from operating activities increased from

EUR 882 million to EUR 935 million thanks prima

rily to the higher operating profit and higher

depreciation.

Net capital expenditure on tangible fixed assets

amounted to EUR 441 million. These investment

activities also include the purchase of returnable

bottles and crates. Substantial net capital spending

took place in the Netherlands (EUR 110 million),

Poland (EUR 78 million), France (EUR 67 million),

Greece (EUR 44 million) and Italy (EUR 34 million).

EUR 89 million was invested in the acquisition and

expansion of participations, while EUR 2 million

was locked up in other financial fixed assets.

1999

change

change

1999

1998

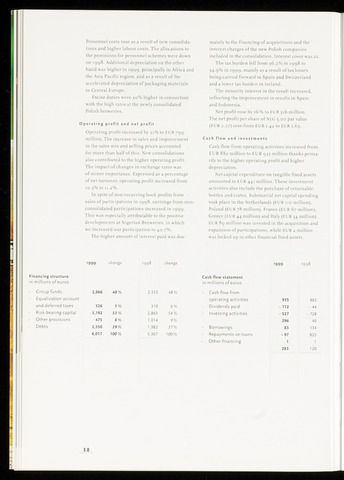

Financing structure

in millions of euros

Croup funds

Equalization account

and deferred taxes

Risk-bearing capital

Other provisions

Debts

2,866 48%

326 5%

3,192 53%

475 8%

2,350 39%

6,017 100%

2,555

310

2,865

1,014

1,982

5,307

48%

6%

54%

9%

37%

100%

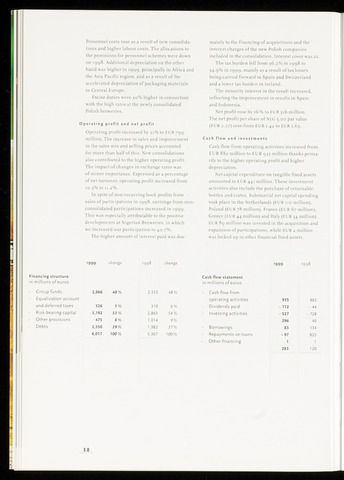

Cash flow statement

in millions of euros

Cash flow from

operating activities

Dividends paid

Investing activities

Borrowings

Repayments on loans

Other financing

935

-112

-527

296

83

-97

1

283

882

-44

-728

40

134

822

1

120

38