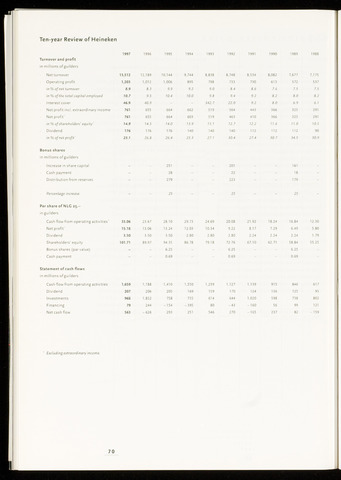

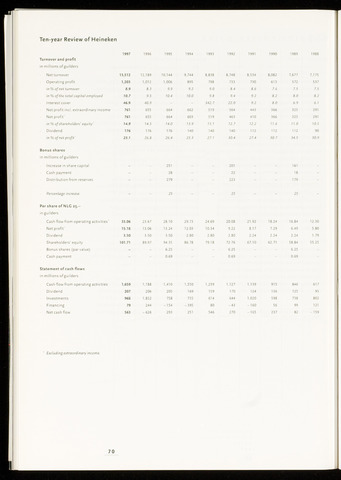

Ten-year Review of Heineken

1997

1996

1995

1994

1993

1992

1991

1990

1989

1988

Turnover and profit

in millions of guilders

Net turnover

13,512

12,189

10,144

9.744

8,838

8,748

8,534

8,082

7,677

7,175

Operating profit

1,203

1,012

1,006

895

798

733

730

613

572

537

in of net turnover

8.9

8.3

9.9

9.2

9.0

8.4

8.6

7.6

7.5

7.5

in of the total capital employed

10.7

9.5

10.4

10.0

9.8

9.4

9.2

8.2

8.0

8.2

Interest cover

46.9

40.9

-

-

342.7

22.0

9.2

8.0

6.9

6.1

Net profit incl. extraordinary income

761

655

664

662

519

564

443

366

325

291

Net profit1

761

655

664

603

519

463

410

366

325

291

in of shareholders' equity1

7 4.9

14.5

14.0

13.9

13.1

72.7

72.2

11.6

77.0

70.5

Dividend

176

176

176

140

140

140

112

112

112

90

in of net profit^

23.1

26.8

26.4

23.3

27.7

30.4

27.4

30.7

34.5

30.9

Bonus shares

in millions of guilders

Increase in share capital

-

251

-

-

201

161

Cash payment

-

28

22

18

Distribution from reserves

-

279

223

179

Percentage increase

-

25

-

25

25

Per share of NLC 25.-

in guilders

Cash flow from operating activities1

33.06

23.67

28.10

29.73

24.69

20.08

21.92

18.24

16.84

12.30

Net profit1

15.18

13.06

13.24

12.03

10.34

9.22

8.17

7.29

6.49

5.80

Dividend

3.50

3.50

3.50

2.80

2.80

2.80

2.24

2.24

2.24

1.79

Shareholders' equity

101.71

89.97

94.35

86.78

79.18

72.76

67.10

62.71

58.84

55.25

Bonus shares (parvalue)

-

-

6.25

6.25

-

6.25

Cash payment

-

-

0.69

-

-

0.69

-

-

0.69

-

Statement of cash flows

in millions of guilders

Cash flow from operating activities

1,659

1,188

1,410

1,550

1,239

1,127

1,139

915

846

617

Dividend

207

206

205

169

159

170

124

136

125

95

Investments

968

1,852

758

735

614

644

1,020

598

738

802

Financing

79

244

-154

-395

80

- 43

-160

56

99

121

Net cash flow

563

-626

293

251

546

270

-165

237

82

-159

Excluding extraordinary income.

70