and the formation of provisions which were not

tax deductible in the financial year. The increase

was limited by the compensation of profit in Italy

and Spain with tax losses carried forward from

previous years, and the benefit of a new tax

facility in the Netherlands.

Net profit rose by 16% to NLG 761 million

in 1997 compared with NLG 655 million in 1996.

Net profit per share rose from NLG 13.06 to

NLG 15.18. Net profit stood at 14.9% of net equity

compared with 14.5% in the previous financial

year.

Cash flow and investments

Cash flow from operating activities stood at

NLG 1,659 million compared with NLG 1,188 million

in 1996. This increase was due to higher

operating profit and depreciation levels, as well

as a reduction in working capital and lower tax

payments.

Cash flow from operating activities per share

rose from NLG23.67 in 1996 to NLG33.06 in

1997. Gross investments in tangible fixed assets

stood at NLG 899 million compared with divest

ments to the amount of NLG 82 million. The most

important investments occurred in the

Netherlands and France and relate to capacity

expansion at the first country and changes to the

production structure at the second. The sum

involved in acquisitions and expansion of existing

interests was NLG 142 million. This mainly

related to acquisition of the breweries in Ghana

and Slovakia, and beverage wholesalers in France,

as well as increasing the shareholding in Multi

Bintang.

After dividend payments and investments,

cash inflows exceeded the outflows by NLG484

million.

Financing and liquidity

Group funds increased by n.8% to NLG 5,504

million. The ratio of Group funds to other capital

employed increased from 0.86 to 0.96. Net equi y

rose from NLG4.5I4 million to NLG 5,103 million

due to revaluation (NLG 134 million) and addition

of proposed profit retention (NLG 586 million),

partly offset by goodwill paid on acquisitions

(NLG 131 million).

Interest-bearing debts totalled NLG 1,588

million, which was NLG 135 million lower than in

1996. Cash at bank and in hand and securities

after deduction of debts to credit institutions,

increased to NLG 1,487 million due to NLG 563

million net cash flow, minus NLG 52 million

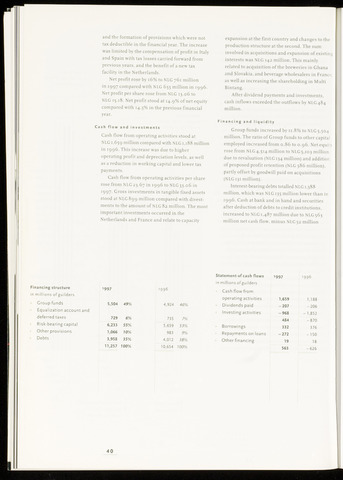

nancing structure

millions of guilders

Group funds

Equalization account and

deferred taxes

Risk-bearing capital

Other provisions

Debts

1997

5,504 49%

729

6,233

1,066

3,958

6%

55%

10%

35%

1996

4,924 46%

735

5,659

983

4,012

7%

53%

9%

38%

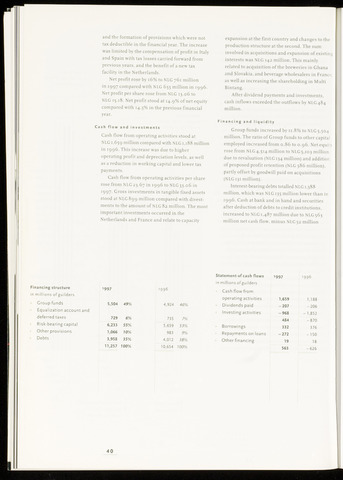

Statement of cash flows

in millions of guilders

Cash flow from

operating activities

Dividends paid

Investing activities

Borrowings

Repayments on loans

Other financing

1997

1996

11,257 100%

10,654 100%

1,659

-207

-968

484

332

-272

19

563

1,188

-206

1,852

-870

376

-150

18

-626

40